Top Fintech Stock In India financial technology , Fintech a portmanteau of “financial technology,” refers to a rapidly growing industry that leverages advanced technology and innovation to provide modern, efficient, and often disruptive financial services and solutions. Fintech encompasses a wide range of activities, products, and services, all aimed at enhancing and transforming traditional financial systems, processes, and transactions. It includes the use of digital platforms, mobile apps, blockchain technology, artificial intelligence, and data analytics to improve access to financial services, streamline operations, and create novel financial products. Fintech companies can be startups or established financial institutions adopting technology-driven approaches to serve consumers, businesses, and the financial industry as a whole.

As India’s fintech industry is expanding rapidly, many investors are looking to buy top fintech stocks. Fintech companies have a good chance of succeeding in the Indian market due to the expanding economy and increasing digital spending. In this article, we will look at 5 Indian fintech stocks that you can consider investing in.

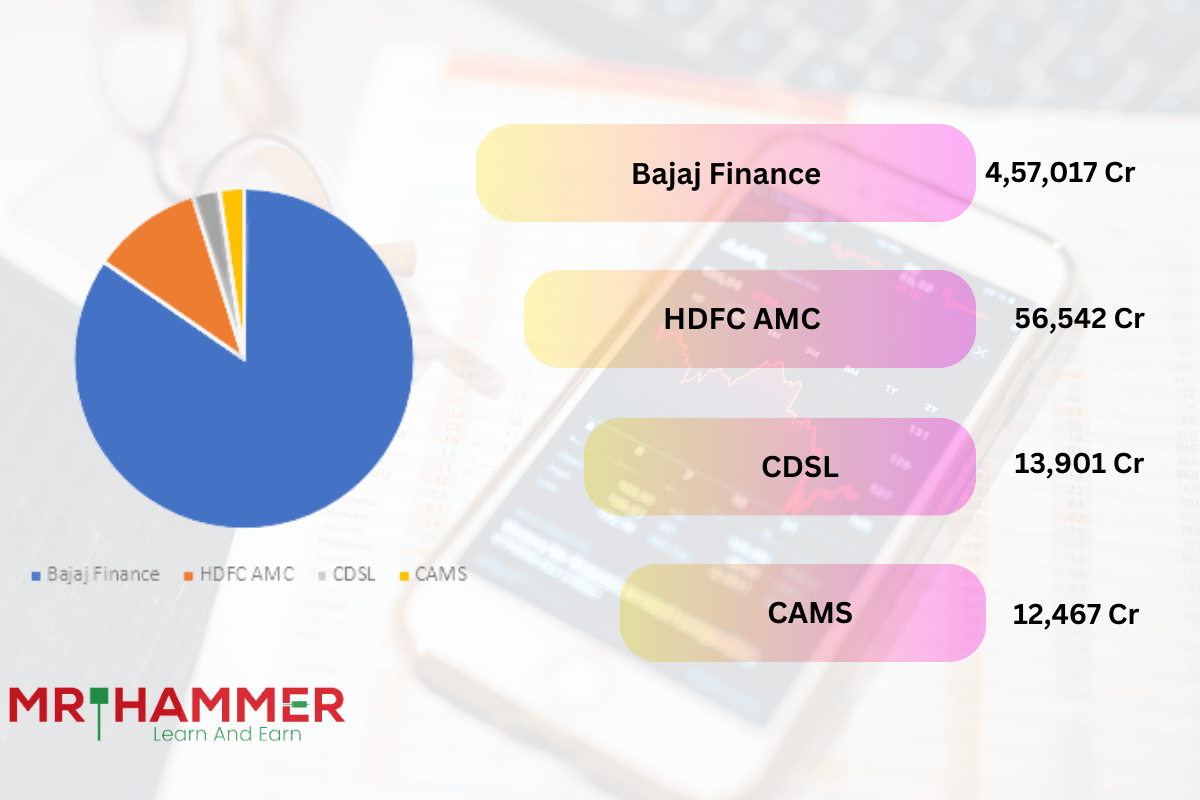

| Stocks | Market Cap |

| Bajaj Finance | ₹ 4,57,017 Cr. |

| HDFC AMC | ₹ 56,542 Cr. |

| CDSL | ₹ 13,901 Cr. |

| CAMS | ₹ 12,467 Cr. |

Why invest in Fintech stocks India 2024

Investing in fintech can be an attractive proposition for various reasons, as the fintech sector offers unique opportunities and benefits for investors. Here are some compelling reasons to consider investing in fintech:

Rapid Growth Potential:

- Fintech is a dynamic and rapidly evolving industry. It has experienced substantial growth over the past decade, and this trend is expected to continue as technology continues to reshape the financial services landscape.

Market Disruption:

- Fintech companies often disrupt traditional financial institutions by offering innovative and more efficient solutions. Investors can benefit from backing companies that challenge the status quo and capture market share from incumbents.

Diversification:

- Fintech investments can add diversification to an investment portfolio. This sector is not closely correlated with traditional financial markets, which means it can provide a hedge against economic downturns.

Access to Emerging Technologies:

- Fintech firms are at the forefront of emerging technologies like blockchain, artificial intelligence, and machine learning. Investing in fintech provides exposure to these cutting-edge technologies with significant growth potential.

Consumer Demand:

- Fintech solutions cater to the changing preferences of consumers who increasingly seek convenient, digital, and user-friendly financial services. As these services gain popularity, fintech companies have the potential to capture a large customer base.

Global Reach:

- Many fintech companies operate on a global scale, allowing investors to access opportunities in various markets and regions. This diversification can help mitigate risks associated with regional economic fluctuations.

Innovation and Efficiency:

- Fintech firms are known for their focus on innovation and efficiency. They often find new ways to provide financial services at lower costs, which can lead to higher profitability and returns for investors.

Mergers and Acquisitions:

- The fintech industry is characterized by a significant amount of merger and acquisition activity. Established financial institutions often acquire fintech startups to enhance their digital capabilities, leading to potential buyout opportunities for investors.

- Regulatory Support: Many governments and regulatory bodies are supportive of fintech innovation, creating a favorable environment for fintech companies to operate and grow.

- Long-Term Potential: Fintech is not just a short-term trend but a long-term transformation of the financial industry. Investing in the sector can position you to benefit from sustained growth over the coming years.

It’s important to note that, like any investment, fintech investments come with risks. The industry is competitive, and not all fintech startups succeed. It’s crucial for investors to conduct thorough research, assess the financial health and business models of the companies they consider, and diversify their portfolios to manage risks effectively. Additionally, staying informed about regulatory changes and market trends is essential when investing in fintech. Consulting with a financial advisor can also help you make informed investment decisions tailored to your financial goals and risk tolerance.

What is the best fintech stock in India -2024 ?

1 #BAJAJ FINANCE.

2 #HDFC AMC

3 #CDSL

What is the Best Fintech Stocks to Buy 2024

1 #BAJAJ FINANCE.

2 #HDFC AMC

3 #CDSL

How big is the fintech market in 2024?

India is amongst the fastest growing Fintech markets in the world. Indian FinTech industry’s market size is $ 50 Bn in 2021 and is estimated at ~$ 150 Bn by 2025

Nice